Decoding the distortions and euphemisms of "reciprocal" tariffs...

Confused by the newsflow on tariffs? Deafened by its dissonance?

Disorientation is natural, because

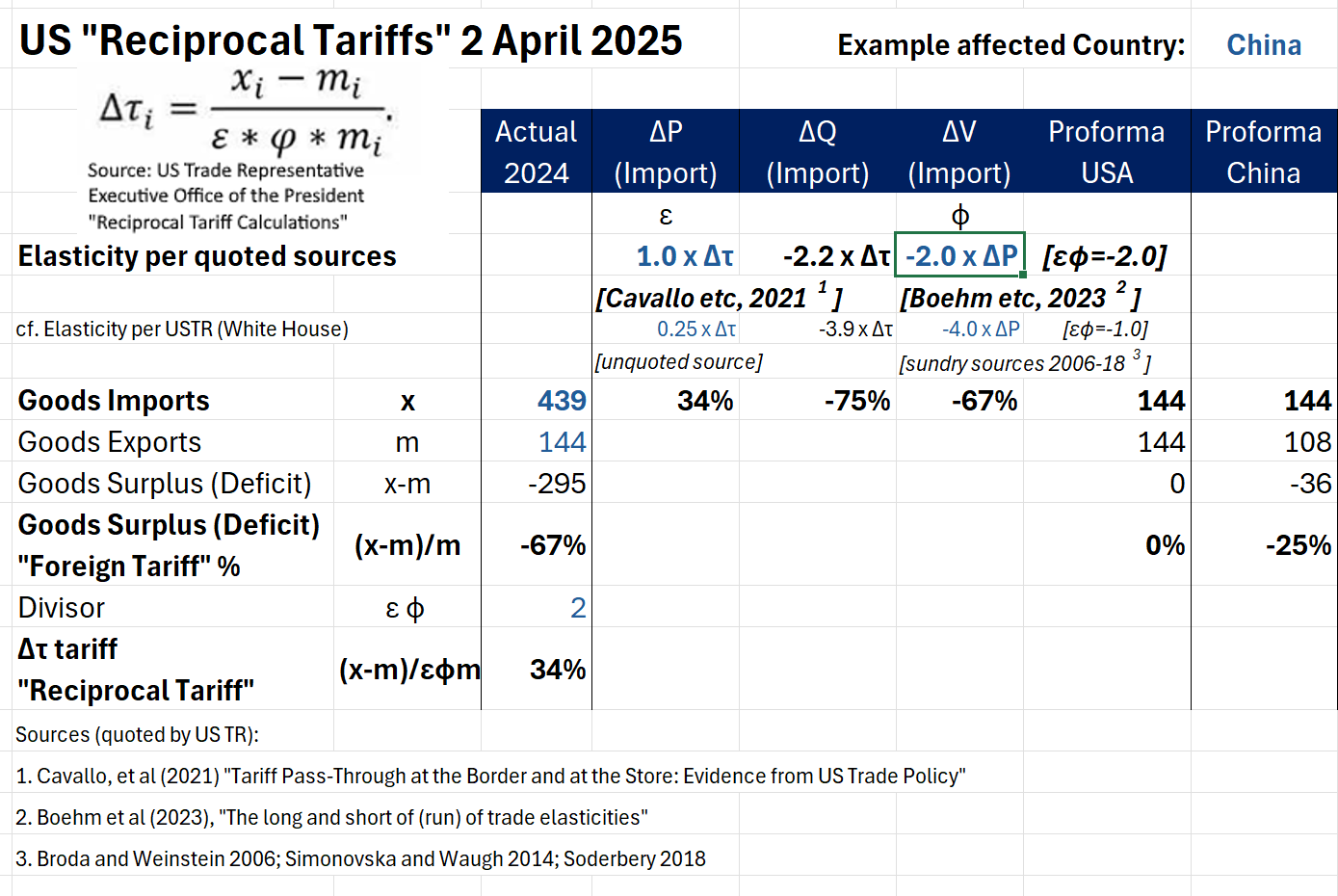

1) the White House uses euphemistic terms which are politically slanted eg

"Foreign Tariffs" for goods trade deficit,

"Reciprocal Tariffs" for modern mercantilism-inspired protectionist taxes

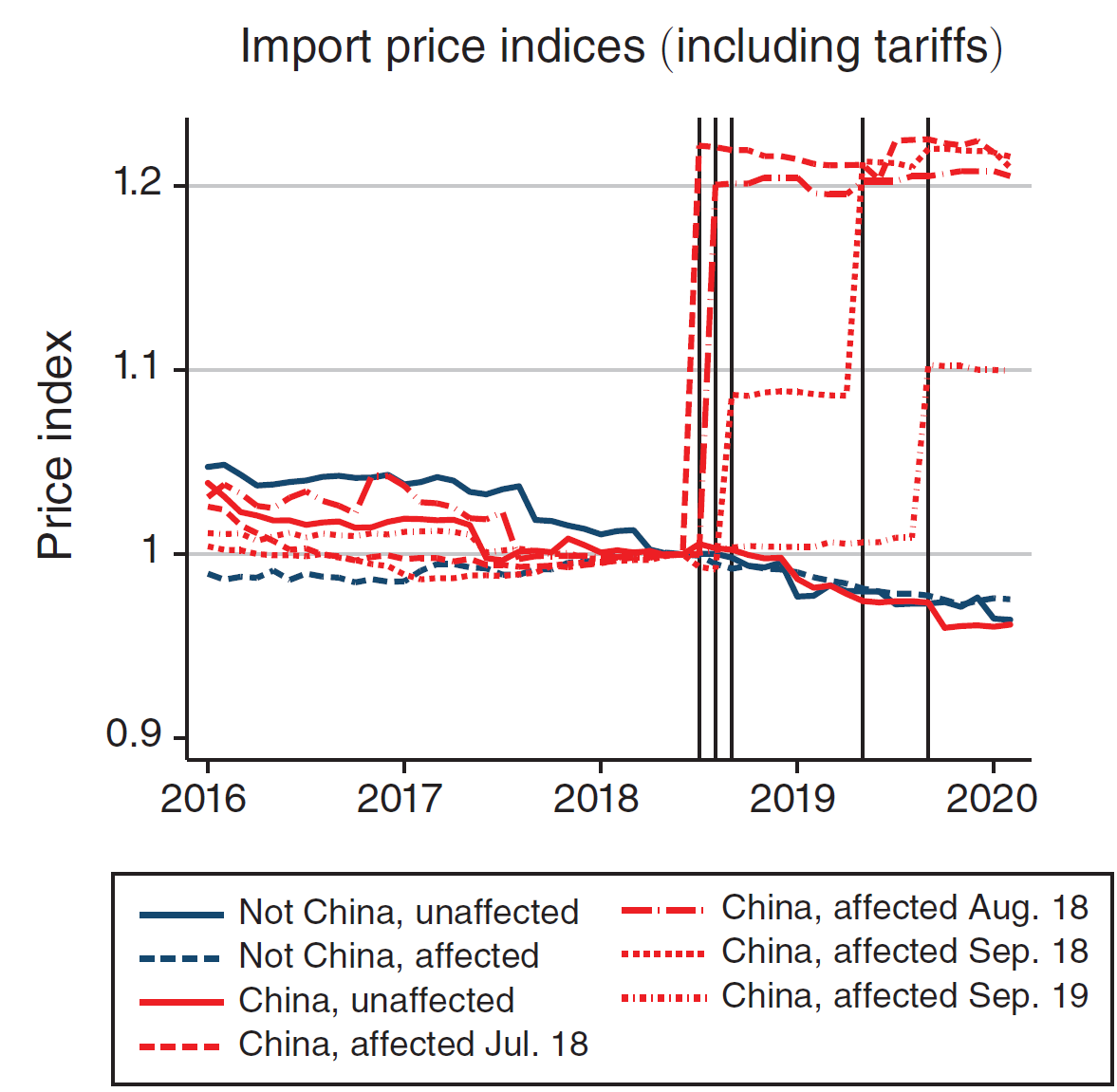

2) the parameters used in the math are distorted by using old research to give the impression domestic prices will be little affected: newer research mentioned but not used gives much higher price elasticity to tariffs (almost 1x rather then 0.25x)

Source: “ Tariff Pass-Through at the Border and at the Store: Evidence from US Trade Policy” By Alberto Cavallo, Gita Gopinath, Brent Neiman, and Jenny Tang. AER: Insights 2021, 3(1): 19–34 https://doi.org/10.1257/aeri.20190536

Applying 2021-3 research instead, the table (linked and below) shows how the US can expect import price inflation of more like 34% on Chinese products than the 8% (0.25 x 34%) which the White House figures imply. And the associated volume reduction of "only" 75% will throw China's surplus into deficit from its point of view

Of course, consumer price increases will be lower because domestic distributors, sales forces, designers etc need to be paid, and their slice of the revenue from consumers is only subject to domestic taxes. For example, Apple's margins on its hardware is about 40% - so the end consumer price on China sourced iPhones will only go up by less than 20% even assuming no export price reductions. Ferraris end prices likewise "only" 10% (Ferrari Plans to Raise US Prices Up to 10% After Tariffs Hit - Bloomberg.)

So will these tariffs really result in sufficient import volume reductions to eliminate the deficits and to stimulate investment in local US production?

And if not, will there be further tariffs .....?

Disagree or agree, your comments are welcome